In short

Acorns: Invest Spare Change is a free investment app for iOS made by Acorns. This is a great app for young individuals and others. It helps to save money.

Highlights

Acorns allows me to save money without having to do anything

I'm in love with this app because I love making money

And so far it has been doing well on the moderate portfolio setting

Acorns is a great way to wet your feet in the investing world

I'm loving the automatic fingerprint scan

I love how easy it is to use the app

I love the keep the change feature

I would highly recommend this to others

Still great investment app

Painless and fun way to invest extra money

My acorns account stopped taking out round ups 3 months ago

I strictly place debit card charges only

It's not going to make you rich but over time change adds up

It's said no wifi connection even though my phone is connected

Include my bank account I can't transfer any money to invest

I don't like the fee that is charged to skim money for myself

And customer service is unresponsive

I've left several messages and no return calls

They decide for me and the stock options aren't impressive

Whole app feels chintzy

Description

WELCOME TO MICRO INVESTING

Investing was for the wealthy. Now it's for everyone! Acorns helps you save and invest small amounts regularly into your own diversified portfolio. Start with just your spare change and join over 1 million who have taken steps to improve their future. It only takes minutes!

FEATURES

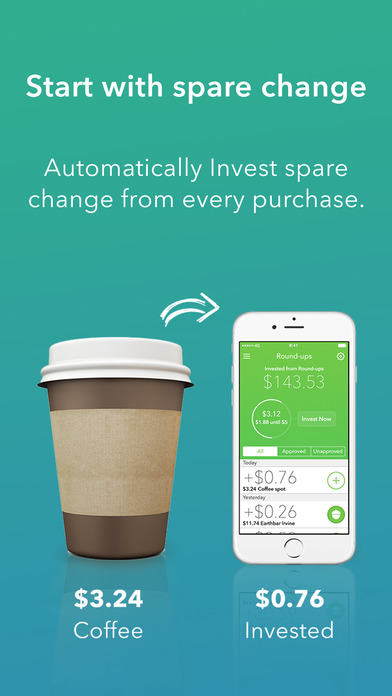

Painlessly invest your spare change into a diversified portfolio of ETFs of over 7,000 stocks and bonds automatically

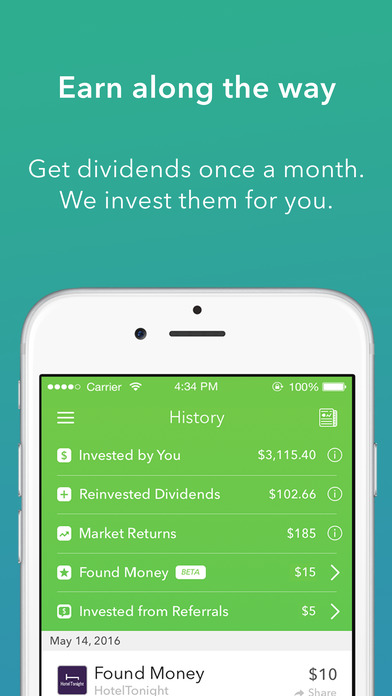

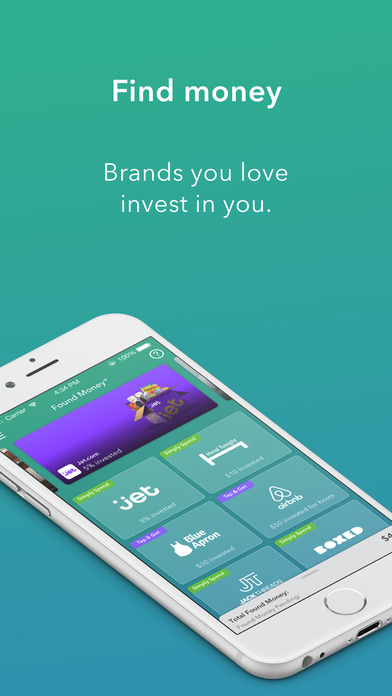

Easily invest more - with Recurring Investments (daily/weekly/monthly), One-Time Investments, Referrals, and Found Money!

Watch your progress – check in on your account from anywhere

SIPC Protected – up to $500,000 is protected against fraud so your money is secure

Stay educated – Gain access to our online personal finance publication, Grow Magazine

Withdraw anytime – at no charge.

WHAT THE WORLD IS SAYING

FORBES: “The app makes investing effortless.”[1]

ABC NEWS: “If you set aside just $5 every couple of days you would have set aside $1,000 in a year.”[2]

WIRED: “Acorns simplified the often tedious and complex process of investing.”[3]

US NEWS: “Acorns offers a unique solution to overcoming the mental barrier: ‘I just don’t have enough money to be investing.’”[4]

TRUSTED AND INTELLIGENT

256-bit encryption to keep your information safe and secure

Automatically rebalances your portfolio

Automatically re-invests your dividends for you

Diversified Portfolio includes hundreds of international companies, corporate and government bonds, and real estate.

PRICE

Acorns costs $1 per month for accounts investing less than $5,000. After your account grows past $5,000, the fee switches to 0.25% per year (@$5,000 that’s about $1 a month). That’s like 3 semi-fancy cups of coffee (you know you do it) a year, just to invest in your future.

In order for Acorns to invest your spare change from purchases, which is part of why we charge $1 per month, you will need to connect a bank account. Worry not - we've got 256-bit encryption. That's a nerdy way of saying we're as secure as the people you bank with. Now, stop reading and get invested.

This app is operated by Acorns Advisers, LLC, an SEC Registered Investment Advisor. Brokerage services are provided to clients of Acorns by Acorns Securities, an SEC registered broker-dealer and member FINRA/SIPC. Investments are not FDIC insured and may lose value. Investing involves risk and investments may lose value, including the loss of principal. Please consider your objectives and Acorns fees before investing. Past performance does not guarantee future results. “Acorns”, the Acorns logo and “Invest the Change” are registered trademarks of Acorns Grow, Inc. Copyright 2016 Acorns and/or its affiliates.

Information about FINRA is available at www.finra.org. Explanatory brochures about SIPC protection are available upon request or at www.sipc.org.

[1] http://www.forbes.com/sites/duncanrolph/2014/09/10/4-online-tools-to-manage-your-money-in-the-21st-century/

[2] http://abcnews.go.com/WNT/video/slow-steady-key-retirement-savings-28043857

[3] http://www.wired.com/2014/08/acorn-app/

[4] http://money.usnews.com/money/blogs/my-money/2014/12/26/wealth-management-tools-for-the-not-so-wealthy

More