ITW Balance 4 EPPICARD

Finance

$1.99

"Save time with the only mobile app that works in all states for EPPICA..."

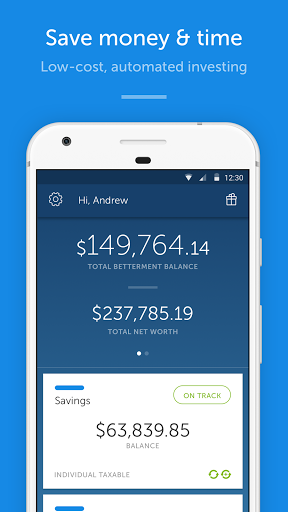

Betterment is a free app for Android created by Betterment. It can be recommended to novice investors. And this is a perfect way to add fingerprint unlock.

Great app for investing EFT's

Great Alternative to a work 401k

Only suggestion I have is to add fingerprint unlock

Super happy with my portfolio performance and ROI

Provides a reliable place to keep extra savings

Perfect for novice investors looking to start somewhere

Fun to watch your investments

Love the SMARTdeposit feature

Customer service is very responsive on instant chat

The app is good for checking balances

Unusable Android app

There is no option available to unlink your bank

Disappointed in recent fee increase

Just getting an error msg every time I try to open it

Latest update crashes when entering PIN

Can't log in to see my balances on my mobile device

Keep telling me that my bank account is suspended and the fact is not

App crashes after pin entry

The app crashes immediately after I enter my PIN

I've tried on at least 5 occasions to open this app to no avail

ITW Balance 4 EPPICARD

Finance

$1.99

"Save time with the only mobile app that works in all states for EPPICA..."

Simple - Better Banking

Finance

Free

"Bank beautifully. Easily budget and save. Simple is online banking wi..."

PocketGuard: Personal Finance, Money & Budget

Finance

Free

"PocketGuard is one of the leading, easiest to use personal finance app..."

Bluecoins- Finance, Budget, Money, Expense Tracker

Finance

Free

"Bluecoins is an incredibly fast and powerful app for tracking and plan..."

Toshl Finance Budget & Expense

Finance

Free

"Toshl Finance helps more than 2 million people keep track of their per..."

Mint: Budget, Bills, Finance

Finance

Free

"Finally, there’s one place to manage all your finances with ease. Mint..."