In short

Personal Capital Budgeting and Investing is a free Android android app developed by Personal Capital Corporation. This is a good app to track investments.

Highlights

Nice app to keep track of finances and investments

This is absolutely the best financial tracking app

Fantastic app for tracking overall net worth and cash flow

You could make the mobile user interface look more catchy

I hope the Android app improves ux quality soon

This is the best personal finance aggregator

Customer Service is excellent and timely

Personal Capital as a service is great

Probably the best free personal finance program

It's great for tracking investments and expenditures

Android is currently much worse than iPhone app

I am not able to Sync my Robinhood account

Too bad you force us to use the app on android

Not compatible with Huntigton Bank

Freemium model is much better

Error pops up when asking to make a pin

I even tried to get it to work from the web site with no luck

Constant headache trying to keep accounts updated and active

Complete garbage when compared to iOS version

No easy way to report problems

Description

Personal Capital's award-winning finance app lets you see all of your accounts in one place and gives you a comprehensive view of your income, spending, and investment performance. Knowing what's happening with your money anytime, anywhere helps you save and invest better.

Personal Capital is on mobile, tablet and now Android wearable devices. It is the only wealth management and investing tool you'll ever need.

ACCOLADES:

“2014 CNBC Disruptor 50 List” – CNBC

"Best 5 Free Apps to Invest Smarter"– CNN

“Time Magazine's 50 Best Websites” – Time

“Best Online Tool to Track Your Investments” – Forbes

“Staff Pick” (2013, 2014) – Google Play

“Personal Capital not only lets you see everything all at once, but makes it easier to manage that money as well.” – Fast Company

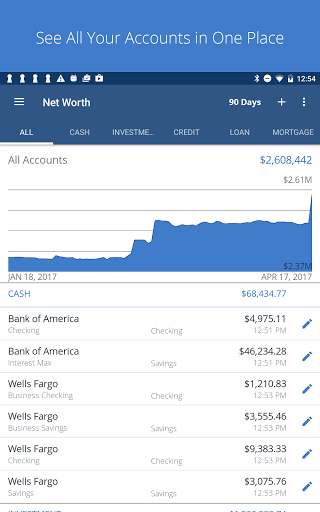

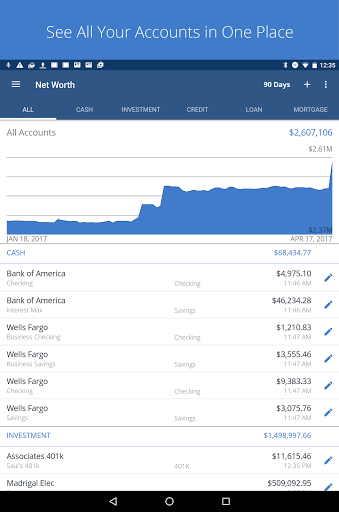

A 360° View of Your Financial Life. Link your investment accounts for free using Personal Capital for a complete picture of your personal finances. At a glance, you can see your checking & saving accounts, credit card spending, and investment performance. The first step to living a better financial life is having all your accounts in one place.

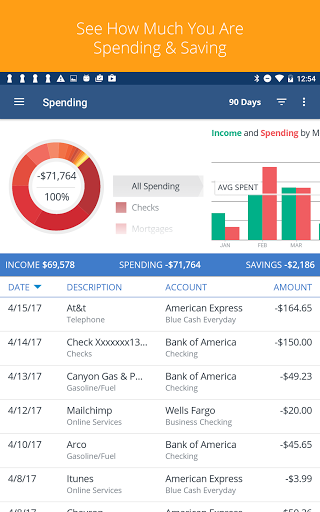

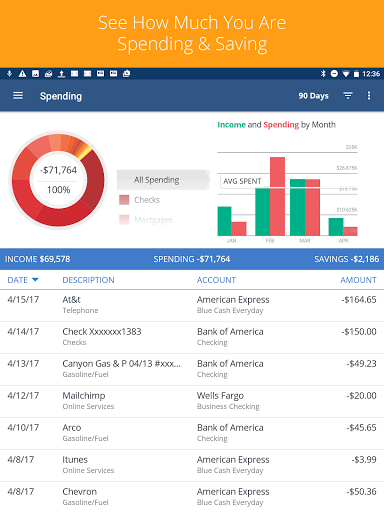

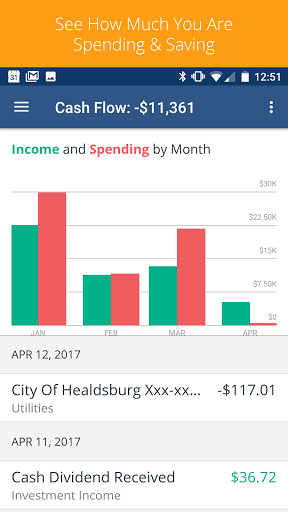

Manage Your Money. Control your spending and finances with interactive cash flow tools that allow you to budget and see if you are spending more than you are making. See detailed income and spending by category and drill down into a category to see the transaction details.

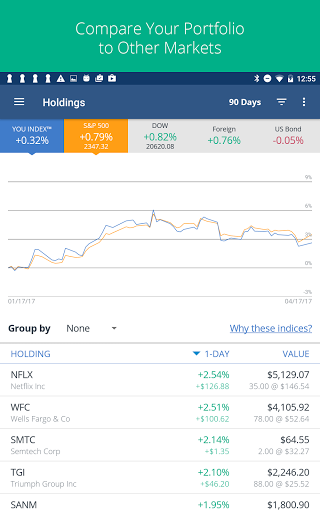

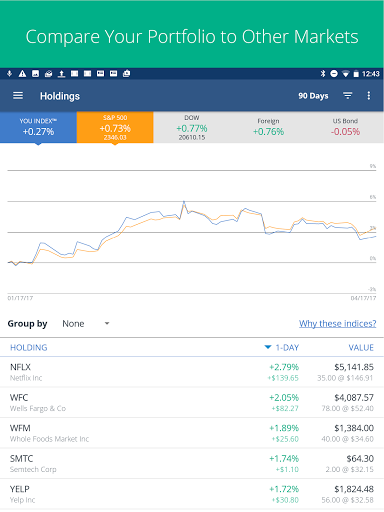

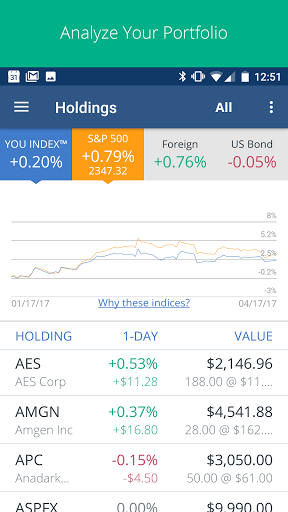

Track Your Investments. How’s the market doing? More importantly, how are YOU doing? You can track your investments by account, asset class or individual security. Compare your portfolio against major market finance benchmarks using the Personal Capital “You Index” and stay on track to meet your investing goals. Install one of the 2 “You Index” widgets to track daily market and individual holdings movement. Know where you stand when it comes to your wealth and investments.

Asset Allocation Review. Built-in investment intelligence will review asset allocation and uncover opportunities for diversification to help you make smarter investing decisions.

Portfolio Checkup. Could your portfolio be working harder? A quick portfolio checkup can potentially save thousands on expensive mutual fund fees.

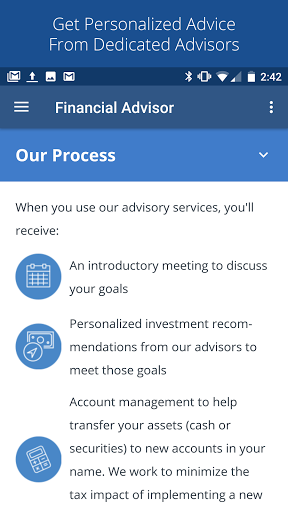

Get Help Meeting Your Financial Goals. On the road to success in your personal finances, it helps to have a guide. As a Registered Investment Advisor, Personal Capital can provide objective investing advice tailored to your goals. Talk with us if you want, how you want. We’ll assign a personal wealth management advisor to discuss your personal finance needs.

Bank Level Security. Use with confidence. Our two-step remote authentication process builds in an extra measure of security to verify your identity and your device, so you can manage your money and finances remotely, knowing your data is safe.

Get Started Now For Free. Linking your accounts is simple– we integrate with over 10,000 financial institutions like Fidelity, Schwab, PayPal, Wells Fargo, and thousands of local and regional credit unions. It takes just a minute to download the finance app and discover a superior way to manage your money and invest smarter.

How We’re Different: People + Technology. Finance and tech experts built Personal Capital to provide a comprehensive and objective wealth management solution for people with complex financial lives. Our software helps you keep track of your short- and long-term money – for free. And our advisors can provide unbiased investing advice and can help you invest in a customized portfolio based on your life and goals.

Android Wear: Get relevant and timely updates on your finances whenever and wherever you need it most. With Android Wear, get daily notifications at market close on the performance of your portfolio and how it performed against major market indices. Swipe to see specific gainers and losers in your portfolio.

More