In short

My Budget Book is an android app for Android made by OneTwoApps. This is a great app for friends. It helps to track cash flows.

Highlights

I love this app for tracking my cash flows

I have searched a lot for finding a good app for tracking my expenses

This is the best app I have used for watching my finances

Such a wonderful personal finance app

Best personal Budget app I've ever used and purchased

It works extremely well as an expense tracker

Fantastic budgeting app

The best financial Android app

One thing I would like added is to be able to log debt repayment

Keep improving this app

No bank integration or cloud storage or PC link software

Can't add in credit card account

Last time my phone got submerged into water and total lost for me

Description

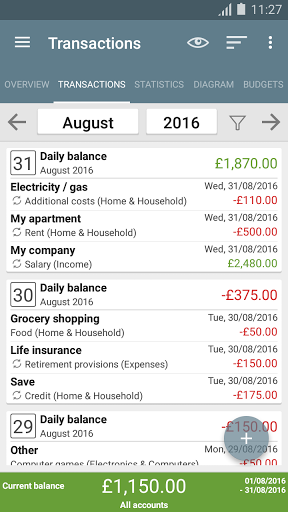

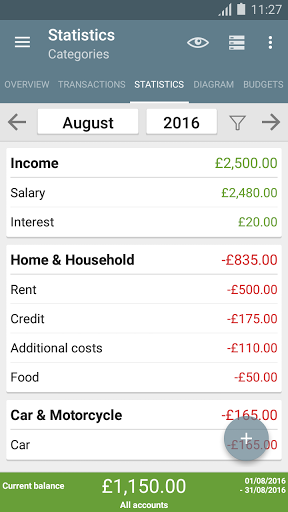

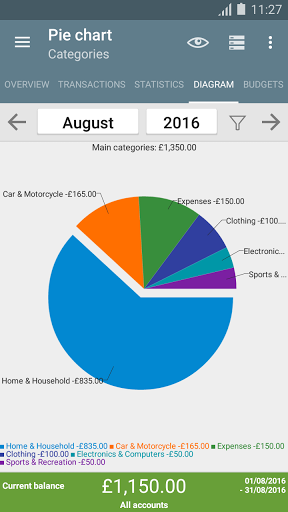

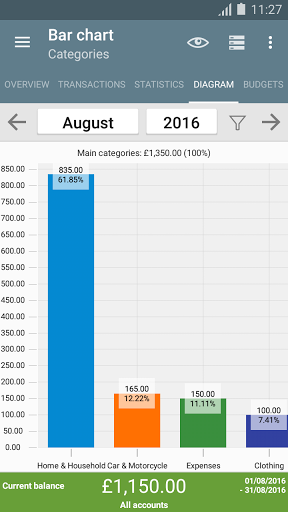

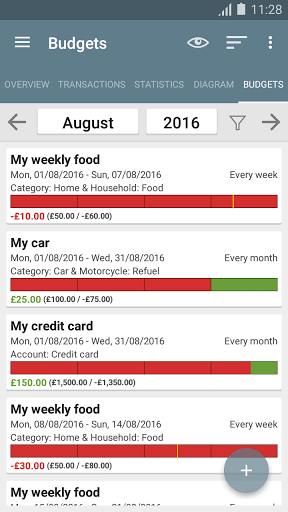

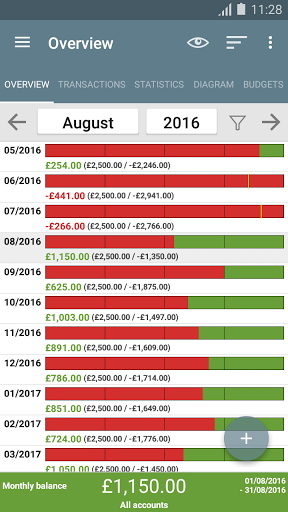

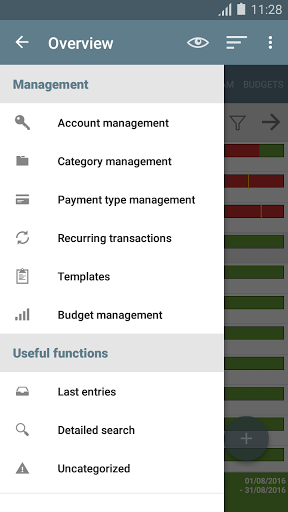

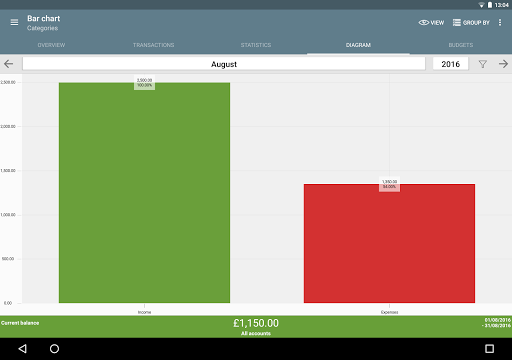

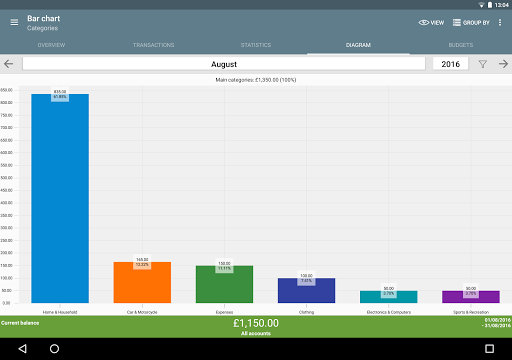

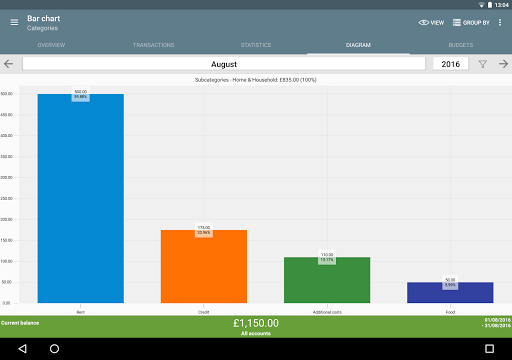

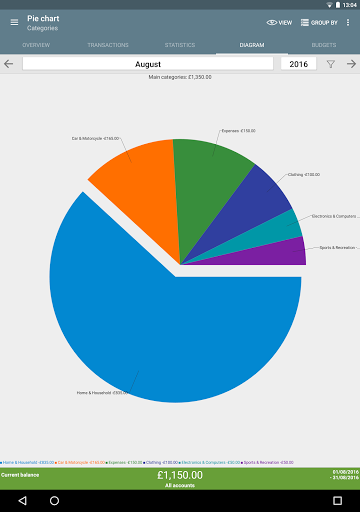

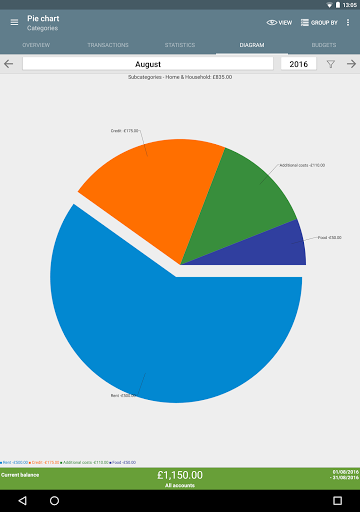

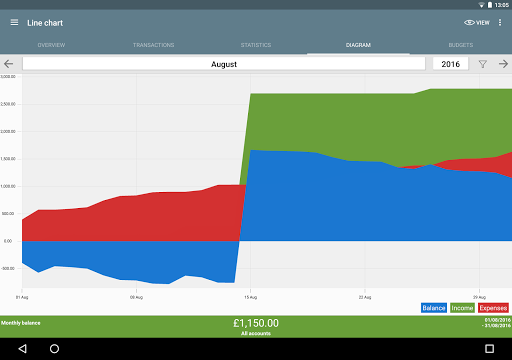

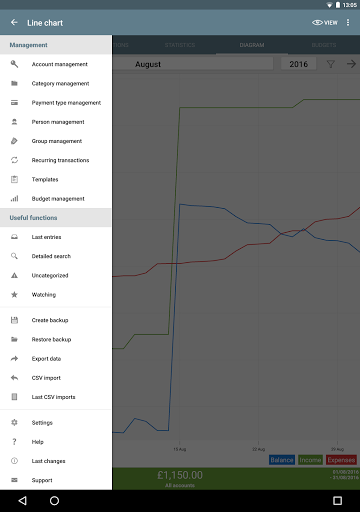

My Budget Book helps you manage your money more effectively through easy recording of your income and expenses. Using the individual or recurring transaction features, you’re able to track and forecast your balances. You can also visualize your records with dynamic charts and graphs. Budget mode allows you to set limits or goals, over custom periods of time. Buying too much clothing? Set a monthly cap. Spending too much on coffee-to-go? Set a weekly limit. Saving for a dream vacation? Set a savings target for every two weeks. Define limits for credit card accounts or other payment types. You can even toggle “rollover” for your budgets – account for every bit owed or saved! Highlights: • Offline: no Internet permission, to protect your privacy. (But you can easily share backups to the cloud.*) • No advertising or hidden in-app costs. • Personalize your Material Design layout. • Comprehensive views, with convenient tabs and a wide variety of sorting options. • Easily visualize your data as tables or graphs, understanding your income and expenses in a new way. • Manage multiple accounts and make transfers between them. • Customize your categories and subcategories to accurately reflect your unique situation. • Enable sorting that distinguishes specific categories, payment types, people, or groups. • Add photos or receipts to your transactions, to remember transaction details or reduce paper clutter. • Use reminders to help you make pending payments on time. • Set the beginning of the month based on your regular salary (e.g. the 1st or the 15th). • Reconcile your expenses with your bank statement. • Create your own templates to make transaction entry even easier. • Protect your sensitive data with a password or fingerprint (optional). • Import existing data or bank statements using the CSV import (other formats may be made available on request). • Export your data as an HTML, Excel, or CSV file, so you may view or print them with your computer. • Automatic local backups so you never lose your data. (Create your own any time as well.) • 4 widgets bring convenience to your home screen. An integrated and comprehensive manual helps you make the most of the features – if you can’t find it there, support is only an e-mail away. *Again, for security reasons, there is no Internet permission. To use the app on multiple devices, or to add automatic backups to your cloud, please read the chapter Synchronization in the integrated manual. My Budget Book is under active development, and improving your experience is a priority. Please feel free to test the app for a month. If it doesn’t fit your needs, just send an e-mail and you will get your money back. If you have any questions or suggestions, please send a message via the integrated Support function.

More