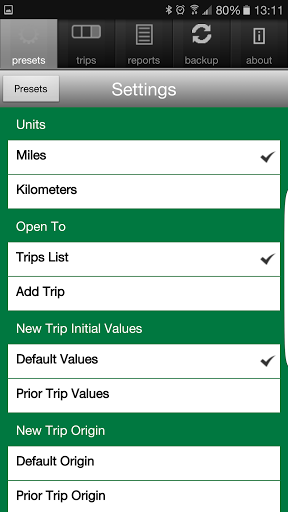

TripLog 2.0 Mileage Tracker

Business

Free

"Most popular GPS mileage tracking app with over 1 million total downlo..."

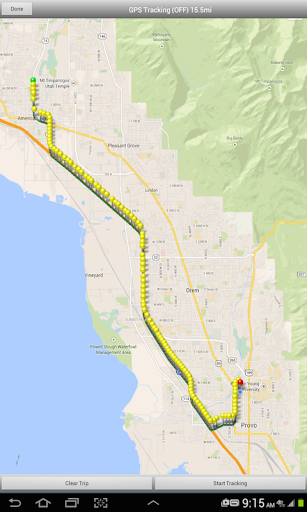

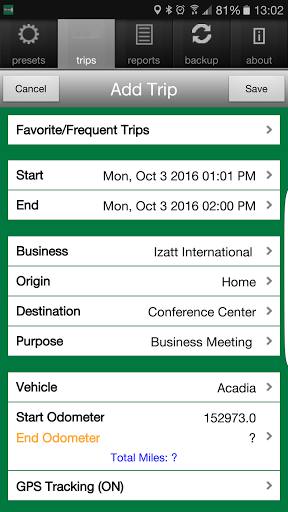

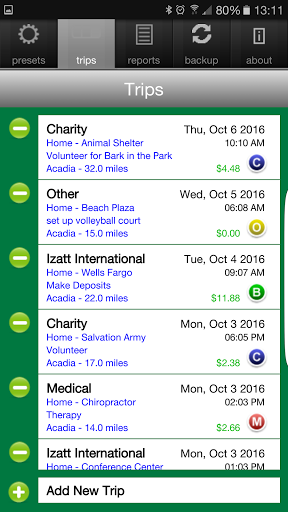

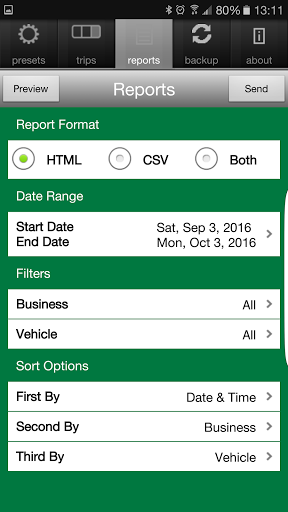

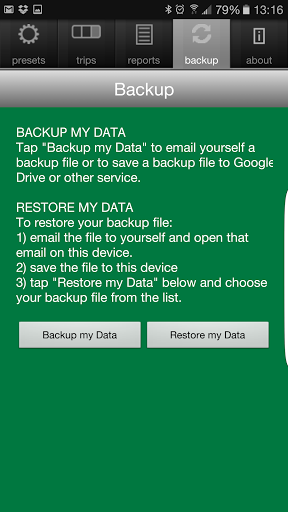

MileBug Mileage Log & Expenses is an Android mileage app from Izatt International. It is suitable for drivers. It is a great way to track mileage.

Use it for all my work trips

It helps me keep track of my trips and starting mileage

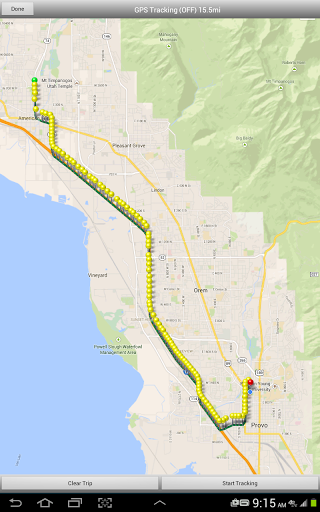

This WAS a great mileage tracking program

But it is a great for just tracking your business mileage

This is a great simple mileage tracker

Easy easy to track mileage

Great for getting your vehicle tax deductions

Recommend to all drivers

It could be a good mileage app again

Great for logging miles

New update broke odometer carrying over to next trip

Rates are not updating and i can no longer enter new trips

Nothing changes and the app is now out of date and frankly buggy

I have unsintalled milebug as it keeps crashing on my ICS SGS II

It doesn't work on my Samsung Note 4

Constantly crashes and needs a phone reboot to reopen

Tried to contact Milebug for help but they did not reply

It constantly jumps to presets settings for no reason

The GPS tracking feature basically doesn't work at all

Tried to delete app and reinstall and still not working

TripLog 2.0 Mileage Tracker

Business

Free

"Most popular GPS mileage tracking app with over 1 million total downlo..."

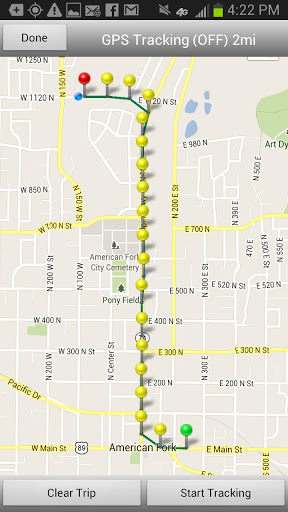

MileIQ - Mileage Tracker

Finance

Free

"MileIQ is an automatic mileage tracker that will have you ditching a p..."

Everlance: Free Mileage Log

Finance

Free

"Throw away your mileage log and shoebox of receipts - Everlance makes ..."

MileCatcher - Mileage Tracker

Finance

Free

"MileCatcher Pro is an automatic mileage tracker that automatically log..."

Taxbot - Mileage & Expenses

Business

Free

"The easy way to automatically track your mileage, digitally store rece..."

Cashbook - Expense Tracker

Finance

$5.99

"Award: No.10 of "The 25 Best Android Apps for Business"by businesspund..."