Warlords - Turn Based Strategy

Game Strategy

Free

"EPIC STRATEGY. HEROIC PROPORTIONS. The turn-based strategy game built ..."

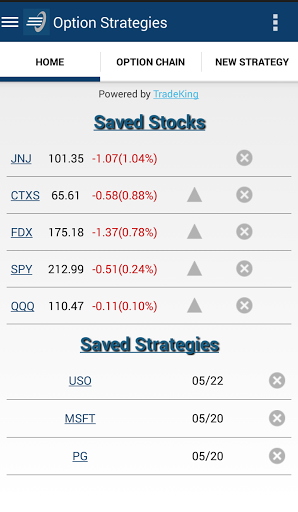

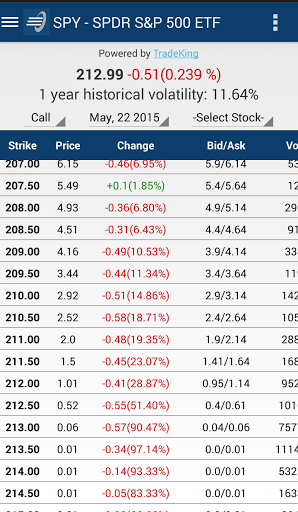

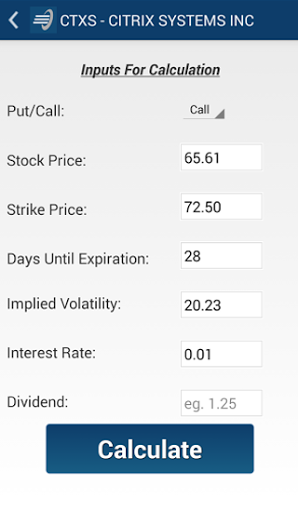

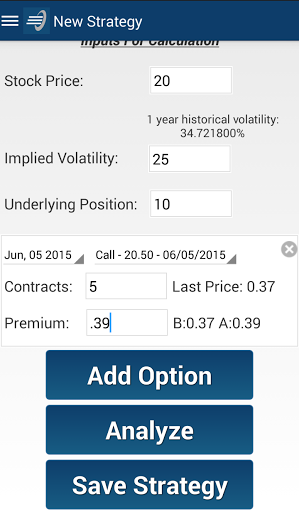

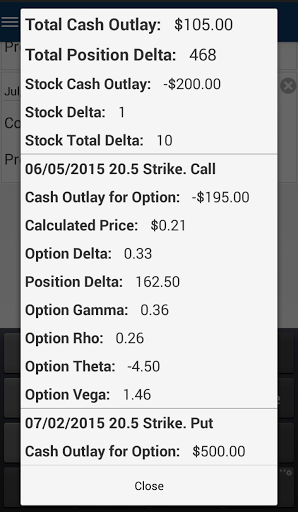

Option Strategies is a free Android app from LWDevSolutions. It is a great way to learn option strategies.

The app helps me practice trading options

Great app to learn option strategies and when to apply those

Overall satified user

Warlords - Turn Based Strategy

Game Strategy

Free

"EPIC STRATEGY. HEROIC PROPORTIONS. The turn-based strategy game built ..."

Simple Finance & Debt Manager

Finance

$3.49

"*** NOTE: This app will be discontinued soon! Please try our app Debt ..."

ClevMoney - Personal Finance

Finance

Free

"[ OVERVIEW ] • Add your incomes and expenses very easily • Managing da..."

anMoney Budget & Finance PRO

Finance

$9.49

"~~~ SALE ~~~ up to 66% Would you believe there could be a personal fin..."

PocketGuard: Personal Finance, Money & Budget

Finance

Free

"PocketGuard is one of the leading, easiest to use personal finance app..."

MoneyWiz 2 - Personal Finance

Finance

$4.99

"Simplify your financial life with MoneyWiz. Have all your accounts, bu..."